SES Functionality Overview

SES policy on the core functionalities of the system.

Approved 10/20/25

This policy provides an overview of the core functionalities of SES, a component of the System1 and any usage restrictions. It also establishes its governance framework and highlights coordination efforts with sister regulatory organizations to ensure consistent standards that enable effective networked supervision.

Functionality Overview

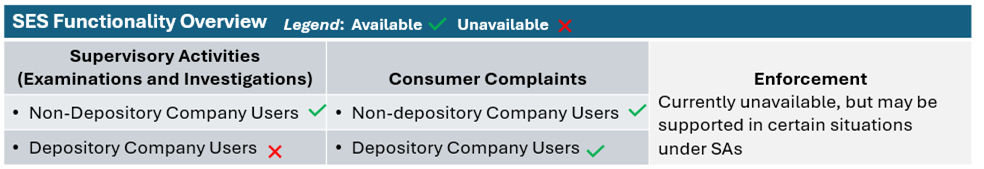

- Supervisory Activities (SAs). SAs encompass examination and/or investigation functionality of Company Users2. Currently, only Company Users with the “Non-Depository” designation can be examined or investigated in SES3. In rare and exceptional cases, SA functionality may be utilized to facilitate enforcement actions against a Company User. This use requires a formal request from a regulatory agency and is contingent upon approval by the NMLS Policy Committee.

- Consumer Complaints. This functionality allows regulatory agencies to transmit

consumer complaints directly to the Company User identified as the subject of the

complaint4. In addition to those designated as Non-Depository, Company

Users with the “Depository”5 designation

may also be the subject of a complaint in SES.

SES Consumer Complaints includes a “Non-NMLS Entity” feature, enabling regulatory agencies to create records for Company Users that cannot be identified through standard processes, and lack a license or account in NMLS. This feature is accessible to all agency users and supports state efforts to detect and monitor unlicensed activity.

- Business Types. As a component of NMLS, SES oversees the supervision of Business Types and their corresponding Business Activities, which can be accessed here. In addition, to support the Depository designation in Consumer Complaints, the Business Types “Commercial Bank” and “Credit Union” are also included in SES.

Governance and Oversight of SES

- NMLS Policy Committee. Responsible for evaluating and approving SES policy matters. The Committee reports directly to the Board.

- SES Agency Advisory Group (AAG). Focuses on development-related topics requiring review. The AAG reports to the NMLS Policy Committee.

- NMLS Lawyer’s Committee. Provides legal review and feedback on significant policy and regulatory issues.

Coordination of Supervisory Standards in SES

- Consumer Finance Standards. Developed, updated, and maintained by the National Association of Consumer Credit Administrators (NACCA).

- Debt Standards. Developed, updated, and maintained by the North American Collection Agency Regulatory Association (NACARA).

- • Money Services Business Standards. Developed, updated, and maintained by the Money Transmitter Regulators Association (MTRA).

- • Mortgage Standards. Developed, updated, and maintained by the Mortgage Standards Examination Working Group, which is overseen by the Non-Depository Supervisory Committee (NDSC). Most of the working group members are also part of the American Association of Residential Mortgage Regulators (AARMR), with which it closely coordinates related initiatives.

Coordination with these organizations occurs on an as-needed basis.